irs federal income tax brackets 2022

Married Individuals Filing Joint Returns Surviving Spouses. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539900 for single filers and above 647850 for married couples filing jointly.

2022 Tax Brackets 2022 Federal Income Tax Brackets Rates

While the tax income tax rates arent.

. Taxable Income Marginal Tax Rate. Here are what the tax brackets will be for the 2022 tax year for the income taxes you must file in April of 2023. The IRS released the new federal marginal tax rates and income brackets for 2022 on Nov.

In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. 2022 Federal Tax Brackets And Marginal Tax Rate. The IRS tinkers with federal income tax brackets each year.

The brackets are the same the income figures have been adjusted for inflation. Here are the federal income tax brackets for 2021 these apply to income earned in 2021 as released by the IRS. Thats nice of the IRS but at the end of the day the government still wants our money.

The 2022 income tax brackets and standard deductions are out. Although the actual income tax brackets have not changed the taxable income range per tax bracket has adjusted upward slightly to account for inflation. 2022 Federal Income Tax Brackets and Rates.

10 of your income. Here are four charts I created for the 2022 income tax. 2019 Federal Income Tax Brackets.

Find out your 2019 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals filing separate returns and estates and trusts. The brackets are the same the income figures have been adjusted for inflation.

2022 Tax Inflation Adjustments Released By Irs

Here S How Rising Inflation May Affect Your 2021 Tax Bill

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Tax Brackets Calculator 2022 What Is A Single Filer S Tax Bracket Marca

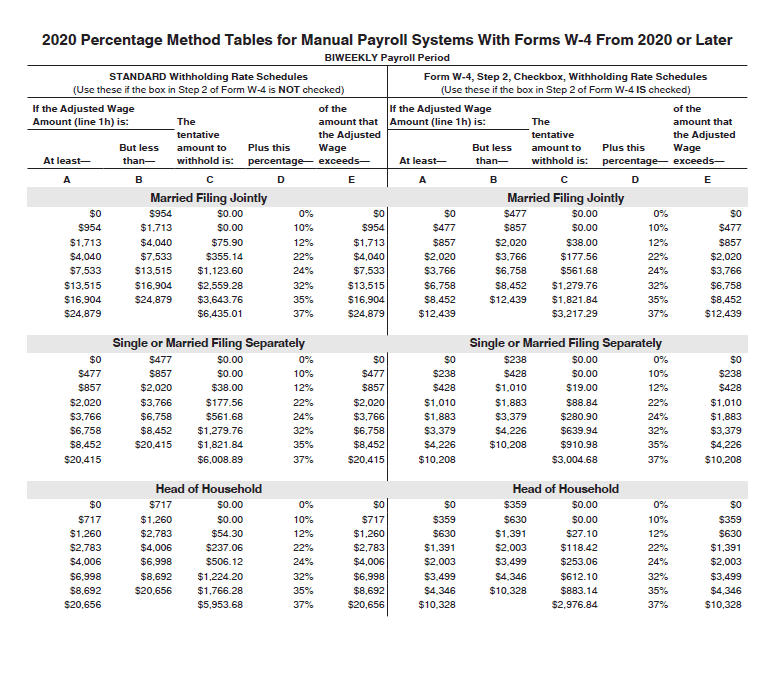

Federal Withholding Table 2022 Payroll Calendar

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

W 4 Form How To Fill It Out In 2022

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management